2020 Metal Markets and the Impact on the Jewelry Industry

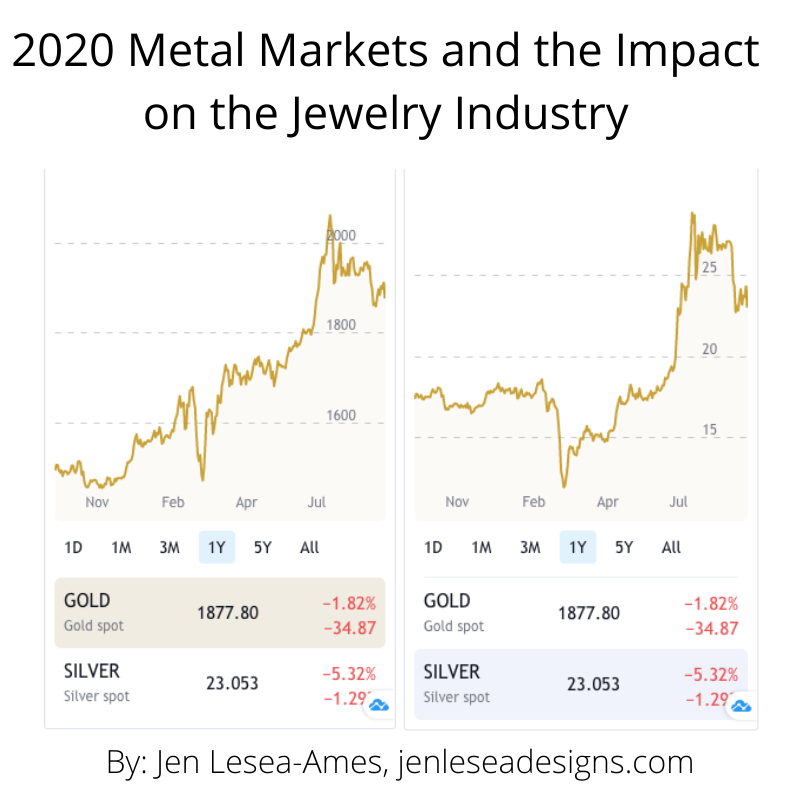

This year has been a wild ride, and the metal markets are no exception. We started the year with silver being around $18/oz, and gold being just over $1500/oz. As you can see from the graph below, there was a sharp dip when we learned about COVID-19, and since then, the prices have increased, spiking in July. This summer, at its highest, we saw approximately a 60% increase in the cost of silver, and 30% increase in gold.

A lot of factors determine the daily prices in silver and gold, and are mainly driven by supply and demand. Political situations, economic conditions, and time of year also play a role. Right now metal markets seem to be relatively stable; it will be interesting to see what happens in early November (election time) through the holiday season.

So, what does this mean for small business jewelers such as myself? We tend to watch the markets and try to time when to buy our materials at a lower cost, but sometimes we are forced to "buy high" when supply is short. I can only speak from my experience, but the increasing metal markets and have greatly affected my profit margins, which is another hit on top of the cancellation of 26 out of 30 of my art shows.

I am trying to ride this out the best I can and keep my pricing the same until the end of the year, as a price adjustment will be necessary for 2021 and I don't want to increase my prices twice within a span of a few months. Currently my 2020 prices were set with silver at about $20/oz and gold at $1600/oz. I am hoping that the current prices stay relatively consistent (silver: $24/oz and gold $1900/oz) through the end of the year.

I share this information with you because it's important to know, as a consumer, the value in precious metal jewelry and the factors of my online promotions. Unfortunately, sterling silver and gold are no longer "cheap", but the investment in jewelry with these quality materials will withstand the test of time and when properly taken care of, will last generations.